Growing up, my grandparents frequently made the trip down to Boston from upstate New York. Whenever there was downtime from the chaos of three kids under 10, they’d turn on golf. We’d half-watch, someone would fall asleep, and then we’d move on to the next activity. Ever since I’ve bucketed golf into the “good to watch if you need a nap” category.

I can’t pinpoint when my opinion shifted. Unlike some of the rabbit holes I’ve gone down, I haven’t tried to learn about golf, but have opportunistically micro-dosed history, form, technique, players, and rules. As I’ve asked questions and learned more of the nuances of game play my attention span has extended.

Earlier this week, another VC described their GP as able to see not just from 10,000 feet but from outer space. How, I asked. They shared the process of picking up a rock and observing it from all sides. Shifting perspective sounds simple if you’re super curious about something, but less so if it’s filed away under nap-inducing.

As a kid, I didn’t share my grandparent’s fascination, preferring the obvious excitement of an NBA game or my Skip It. Golf, for me at least, requires the patience of learning enough to become interesting.

We have The Masters on this weekend. Decades long players continue to practice, refine and compete. They’re hedgehogs, not foxes.

Hedgehogs are surprisingly resourceful. They are naturally curious about everything and anything related to their pursuits. They like to tinker, experiment, and learn, and if changes are required, they can snap to action in a nanosecond. Hedgehogs may not be as clever as foxes but they obsessively measure and track everything about their business, and over time, they acquire deep, relevant knowledge and expertise.

Foxes and Hedgehogs, Ho Nam, Altos Capital

It seems the key to appreciating the nonobvious lies in cultivating a hedgehog-like curiosity and a willingness to learn from every angle. What nonobvious thing are you curious about?

What I read this week

🎧 on what strategy really is for startups - Packy McCormick, Not Boring on The Splinter

In this market, what are the things that we can do really well, what are the things we can do better than anyone else despite the lack of resources? What are the things that we should ignore and not try to do.

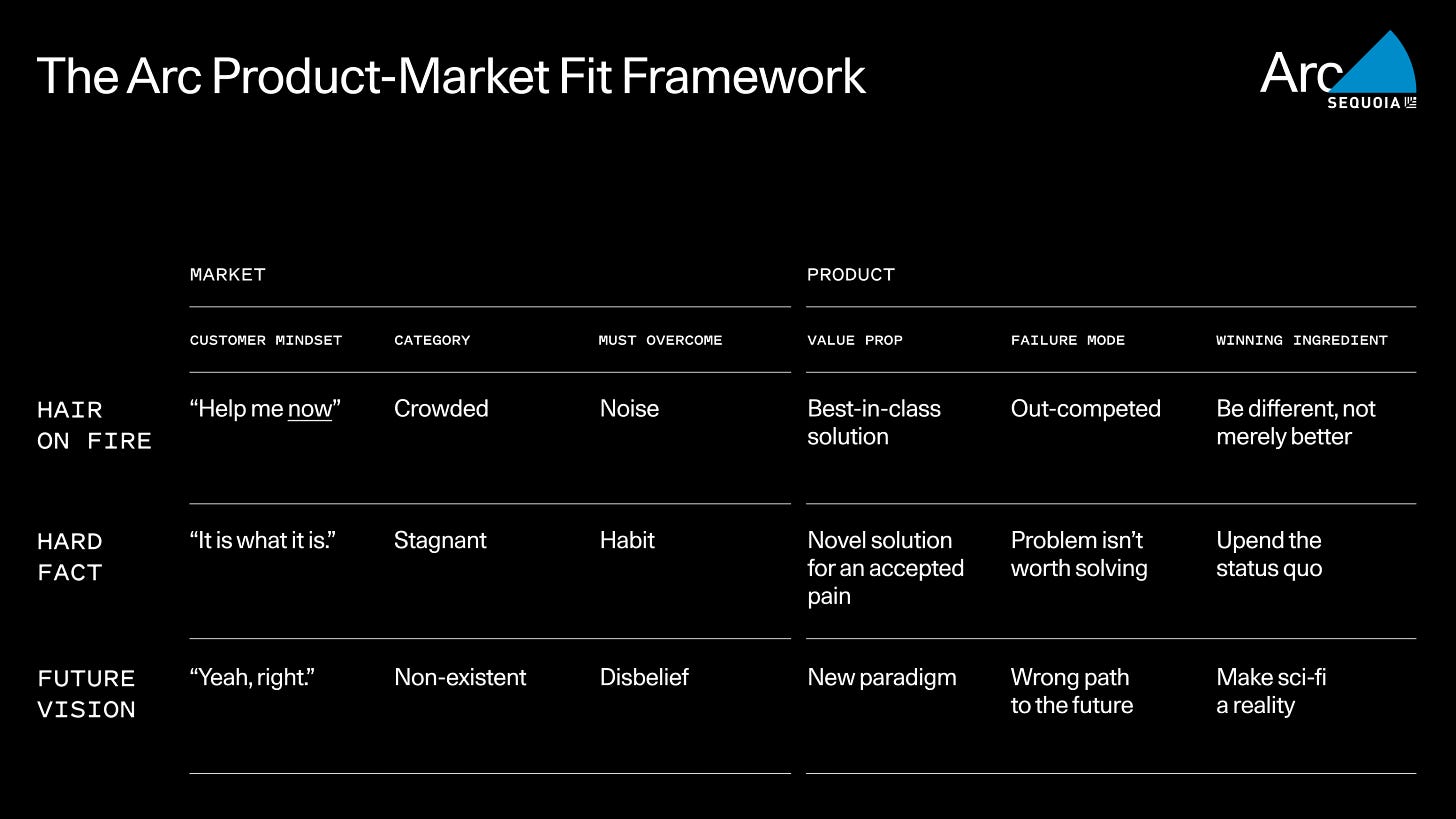

🛠️ The Arc Product Market Fit Playbook - Jess Lee & team, Sequoia

The Hair on Fire path requires both a great product and a great go-to-market effort—in quick succession.

The Hard Fact path entails getting customers to re-evaluate and change the way they approach a current process. This requires first educating the market, and then capturing the opportunity.

The Future Vision path has the most ways to fail and the fewest to succeed, but potentially the largest payoff. Taking this path requires endurance and the ability to attract and retain top talent for the long haul.

💡 on Toni Morrison’s rejection letters - Melina Moe, Los Angeles Review of Books

Morrison’s rejections tend to be long, generous in their suggestions, and direct in their criticism.

Often, she supplements her rejections with diagnoses of an ailing publishing business, growing frustrations with unimaginative taste, the industry’s aversion to risk-taking, and her own sense of creative constraint working at a commercial press. Morrison outlined how the economics of a book project depended on the mechanisms of distribution.

💛 letter to a friend who may start a new platform - Graham Duncan, East Rock Capital

My hope for you is that your new venture will take you far away from the sprawl of the smelly, transactional gas stations, and will instead be an artistic adventure, full of unexpected highs and lows, with just enough gas in your car — or better, fighter jet — to let you stay nimble and still go far.

🌊 in defense of academia - Ben Reindhart,

The mentor-apprentice relationship that ideally characterizes the interactions between a professor and a grad student may be the only way to incept the thought patterns of top scientists. Academia is one of the only places where active, cutting edge research labs are incentivized to train novices. A rule of thumb is that the average grad student is a net drag on productivity until their third year.

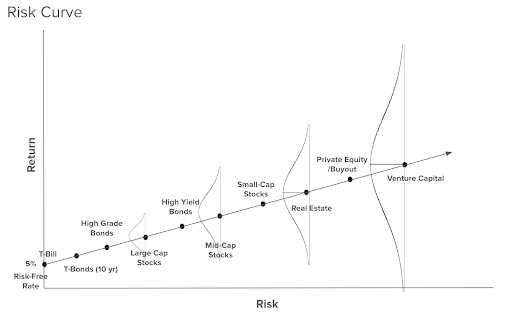

📊 how risky is venture capital really? - Jamie Melzer & Katie Nowak, Hustle Fund

As you move up the risk curve, the potential outcomes start to widen. Your 95-cent angel investment could become 0 cents … (and has a high probability of doing so) ... or, your 95 cents could 100x into 9,500 cents! 🤯 (though this outcome has only a 1-2% probability).

I see you, I love you, be the hedgehog,

H