Reflections on my 1st 1,000 intro meetings: VC SOM, market size, and thinking in bets

I originally shared some thoughts with LPs that have since come up in conversation with founders and other investors. Sharing here to continue the conversation.

Since joining Hustle Fund, I’ve gotten to review 1000s of companies, meet 1:1 with >1,000, and back 30 teams.

Over the last few weeks, I’ve revisited the companies I’ve invested in, my anti-portfolio, and my assumptions to get better at saying no a lot, and faster, as well as the ROI of where I spend time. We say no to 99.3% of the startups we meet with, and I expect that to increase as we continue to grow our incredible community and scale top-of-funnel.

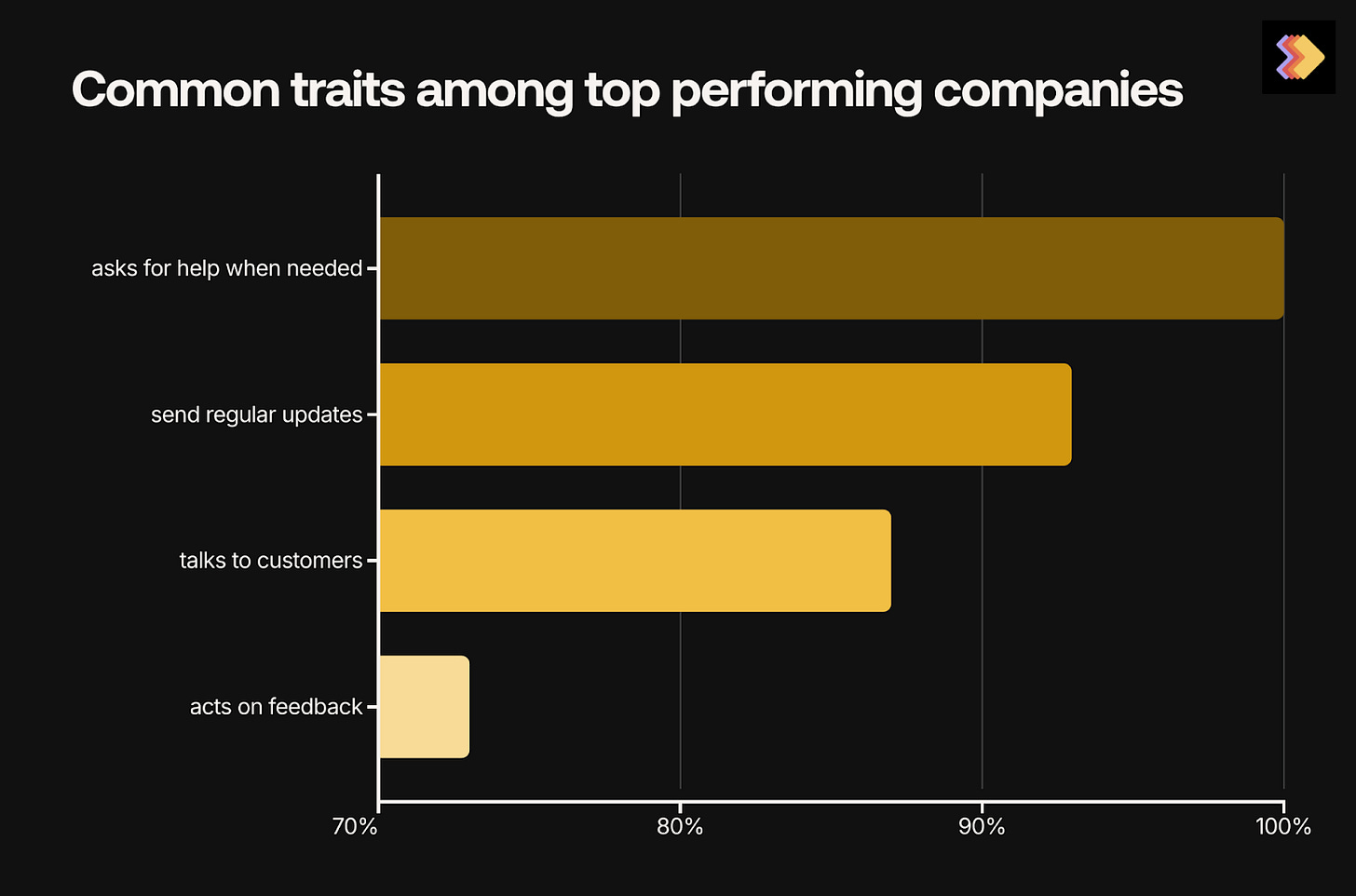

While it’s too early to know which companies are going to have huge outcomes, the common traits among both the top-performing companies and those navigating their wilderness years are becoming clear.

Half of the time we’re the first check in, and almost always help founders pull rounds together. One of my favorite things about our portfolio construction is that the rounds we invest in often have space for other investors, and our strategy enables us to spend time building long term relationships.

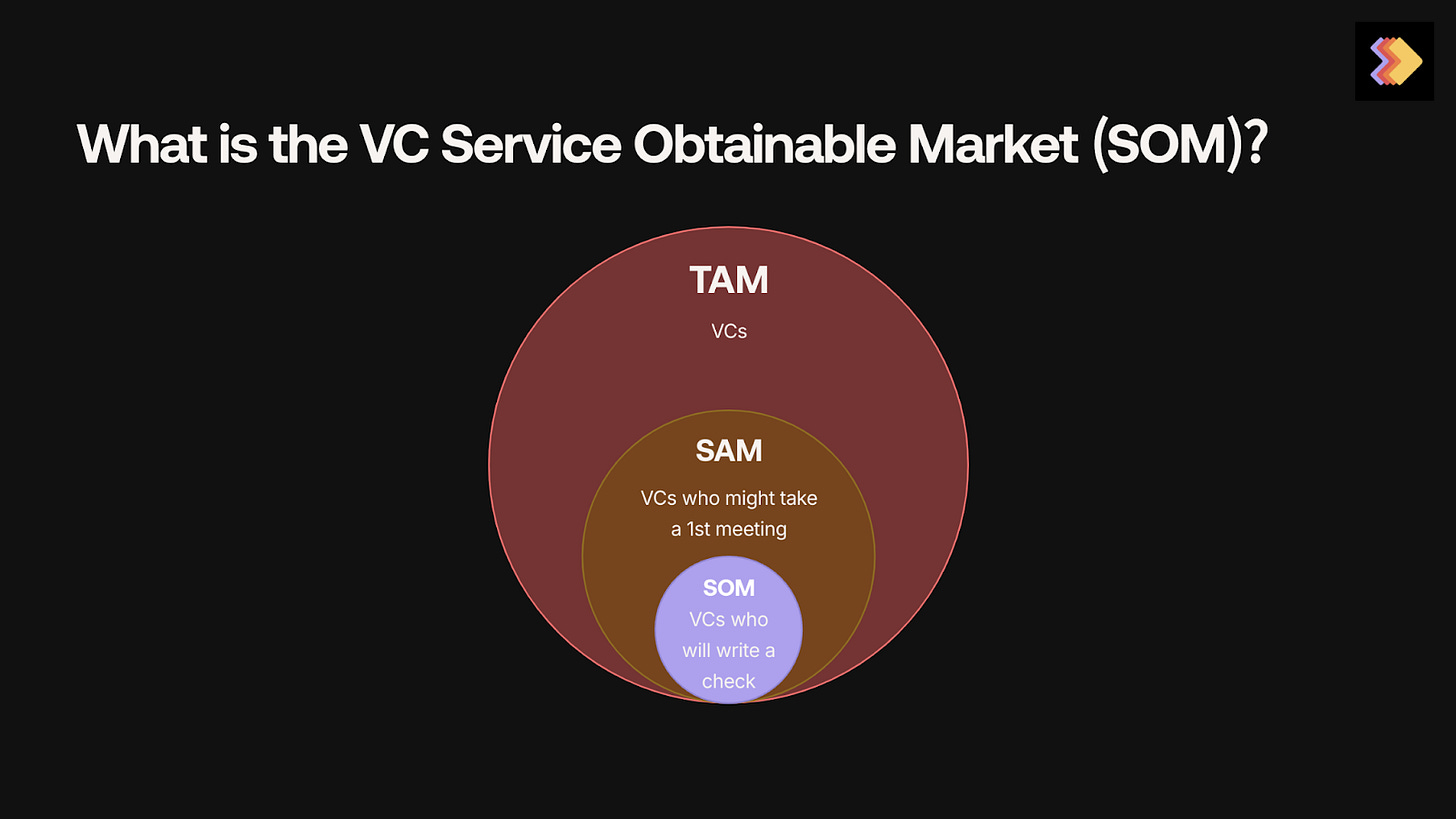

When I’m close to conviction on a company, one of the first things I think about is what VC friends would get the idea, market, and/or founder. It’s a key part of my process because in my first two years at Hustle Fund, I’ve come to realize that often a startup’s initial investor service obtainable market (SOM) matters more than their product’s initial SOM.

Increasing VC SOM by avoiding the “too hard” zone

Early on, I evaluated each startup’s fundraisability without deeply considering investor SOM. What is investor SOM? Beyond the team’s storytelling ability and the scalability of the idea, their investor SOM is the number of other VCs who might be interested in doing the deal * their potential check size.

Many companies overestimate their investor SOM, targeting every fund investing at their stage or sector. We automatically say no to about 50% of the companies we see each month who apply despite being outside of our strike zone.

The companies I’ve seen struggle to raise operate in the “too hard” zone, which significantly shrinks the number of potential investors they can move through their fundraising funnel. From year 1 to year 2, I’ve spent less time on companies that seem too hard because of some combination of:

revenue quality

sector

business model

market dynamics

geography

What is considered too hard will shift with trends, and if/as companies progress towards product market fit. But to invest, I have to believe that the company can survive for long enough to become obvious.

In chatting with founders about potential co-investors, I try to map their investor SOM back to our network. We’ve been lucky to collaborate with 1,500 other VCs over the last 7 years, and have gotten to know their deal taste over time.

Capital is a commodity. Our right to win a deal and ability to meaningfully support founders is a function of our networks and knowledge.

The opportunities I’m most excited about at pre-seed exist outside of the too hard zone but are still passed over by many investors because the market, product or traction are too early or the founding team is underestimated in some way.

Increasing our check size to $150k means it’s easier for us to make these very early bets and for teams to get far enough to grow their investor SOM and pursue the 100x scale that Elizabeth talked about in last month’s update.

Building verticalized portfolio network effects

Beyond investor networks, I also think about what other portfolio founders I can intro the team to to help them with customer acquisition or industry intel to accelerate their business. While we are fairly generalist at Hustle Fund investing in picks and shovels software businesses across many industries, we are now at a scale where we’re able to provide quite verticalized support by connecting teams building in the same space or similar types of businesses.

For example, Raphael, Shray and Gabe at EZee Assist, AI knowledge management for franchisors, are working through multi-product sequencing. They have incredible hustle, are great at stakeholder management, and both execute in the now while thinking strategically about what’s next. Over the last quarter, they thought deeply about natural extensions of their current feature set, driving cost savings for their customers and how to increase ACV before building ticketing into their platform.

They’ve offered to share their decision framework and research with other companies in our portfolio. While there’s so much variance between industries, other vertical SaaS companies like Ampere for industrial SMBs, RingRadar for the equestrian industry, SWIP for air cargo logistics and Park for campground payments will benefit from this knowledge.

Overcoming the market size objection

This brings me to market size.

When EZee Assist launched, they got a lot of feedback about market size. There are over 800,000 franchised businesses in the US generating >$700 billion per year, but they started in Canada, the software market for franchise management is around $1 billion, and their revenue per franchise seemed low. As they’ve consistently hit targets, the conversation with potential investors has shifted away from market size towards how to build the layer cake to become a giant business.

I’m seeing this pattern repeat in other vertical SaaS companies building in markets that may seem small at a glance. I love backing customer-centric founders who see potential where others don’t, and have a strong hypothesis about how they might super-serve a customer to expand lifetime value (LTV) and build a fund returning business.

In the fall of last year, Danny and Alex at PunchUp pitched us on an ecommerce enablement tool for comedians. They were just 3 months and 8,000 monthly active users (MAUs) into the product, but there were already signs of strong market pull. The live comedy market is just $900m but it’s doubled since 2019. They’re further expanding the market by helping comedians sell more tickets, content and merch, with bigger plans for the future. They now have over 300k MAUs, just launched a comedian management app, and welcomed Larry David to their user base.

Jen at Coral Care struggled to find pediatric specialist care for her daughter, so built a startup to remove friction and provide insurance-covered access for other kids and parents. Jen saw the potential to centralize fragmented supply and create a high retention experience that makes revenue look more like SMB than consumer. It may sound niche, but 1 in 6 kids in the US have developmental delays.

VC SOM and portfolio network effects will help us be early in re-emerging markets

We tend to stay away from consumer. Less than 10% of our Hustle Fund III portfolio is consumer focused. But, 60% of the companies and 80% of the value of unicorns a decade ago were consumer companies. AI tailwinds are creating an interesting “why now” for new ideas and the disruption of incumbents. And the focus on capital efficiency from day one means sustainable unit economics are core to the pitch of the best founders building in consumer today.

I jumped at the opportunity to meet Jen at Coral Care opportunity after exploring famtech with an angel investment in Joon (task manager for kids with ADHD) a few years ago and a Hustle Fund investment in Happypillar (play based therapy) in 2022. Coral Care, Joon and Happypillar have all gone on to raise seed rounds with support from established and emerging managers paying attention to this market.

The most underserved consumers are often our kids and our parents, the long tails of the population. Raising digital natives and caring for a more tech forward aging population requires new tools. Customer-obsessed founders with strong go to market abilities can unlock much bigger revenue opportunities through b2b2c. That’s my bet on Poppins (parenting virtual assistant) and Kidsy (b2b2c liquidated kids gear), which is collaborating on customer acquisition with Elizabeth’s portfolio company Future Money (Junior Roth IRAs).

I believe that the investor SOM will increase for consumer founders selling pills vs vitamins. If no one is interested in investing in a space that has massive unsolved problems, there is an interesting valuation arbitrage opportunity. Founders are forced to compete on product, value for customers and business model versus marketing budgets funded by dollars raised. Consumers are less interested in being “marketed to” or “influenced,” Instagram ads don’t win loyalty.

Rupa Health started as a consumer idea in an emerging market before pursuing a bigger b2b opportunity. They were acquired by Fullscript in October 2024. Meowtel sounded kind of crazy. Yummy in Venezuela may have at a glance sounded too hard. But as we’ve learned time and again, today’s hottest categories are poor predictors of tomorrow’s market leaders.