I caught up with a mentor on Friday. We’d only met once in person previously but I watched from afar as she led a company with $100s of millions in revenue. I didn’t have an ask for her. I was just excited to spend time.

We talked about life, her life mostly - friends, family, transitions.

We started the relationship from a place of vulnerability. She was a sounding board when I was deciding whether to step back from my COO role in 2021. I caught up with a few coworkers from that company this week and for the first time out loud shared that I was heartbroken leaving.

Sometimes you get so…

Tangled up?

We both nodded.

Vulnerability is a foundation for intimacy. Intimacy takes time. In December, I had lunch with a friend and in five minutes learned more about him than I had in the previous 18 months. A long walk with a usually shy 5yo yesterday opened up hours of conversation. A friend shared that they waited for 1.5 years for a 2nd date with their now partner. With people, slow is fast.

I spend a lot of time on intro calls, trying to learn enough about ideas and founders to explore further and commit $150,000. In 30 minutes I get the pitch, a snapshot of the founder’s demeanor, and a sense of whether this is the first of many conversations.

Most of the time it’s a no, sometimes it’s a yes, occasionally it’s a not yet. Increasingly it’s a meeting without a specific call to action…the product isn’t built yet, they aren’t ready to raise, we’re just exchanging intros. We stay in touch over months or years and maybe reconnect.

A Q1 update came in this morning from a founder I’ve been getting to know for six months. They followed through. I’m ready to move fast.

What I read this week

🎥 this email changed the credit card industry - Ramp Documentary

The impact that we drive for companies is we help the average company spend 3.3% less each year, and close their books 8x faster. We have saved thousands of hours of rote tasks that no longer need to get done.

🛠️ turning a basement hatched idea into a billion-dollar exit - James Barlia, Revolution

Every single business is an LTV/CAC equation.

(Truebill) meticulously tracked everything. They understood all of their business's levers and were able to invest time and resources when they found a lever that accelerated growth or profitability.

The company grew 500%, 400%, 300%, 200% – an investor's dream. Yet, even as second-time founders with solid metrics, investors continuously rejected them.

💛 a lesson in friendship - Farnam Street

Friendship is more than being there for your friends, it’s also allowing your friends to be there for you.

🎨 the middle finger poem - Yrsa Daley-Ward, The Utter

See the persistent, awful news,

See the updates no one wants to hear or know about.

See the numbers - have you seen the numbers?

🤖 OpenAI speech-to-speech reasoning - Figure

Can I have something to eat?

Sure thing.

📊 future of autonomous agents - Yohei, Incisive Capital

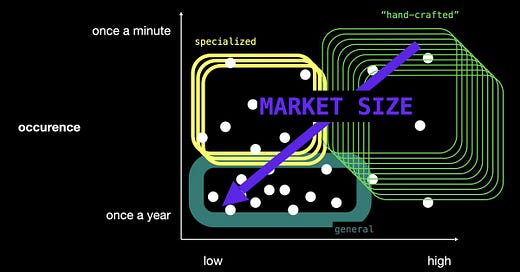

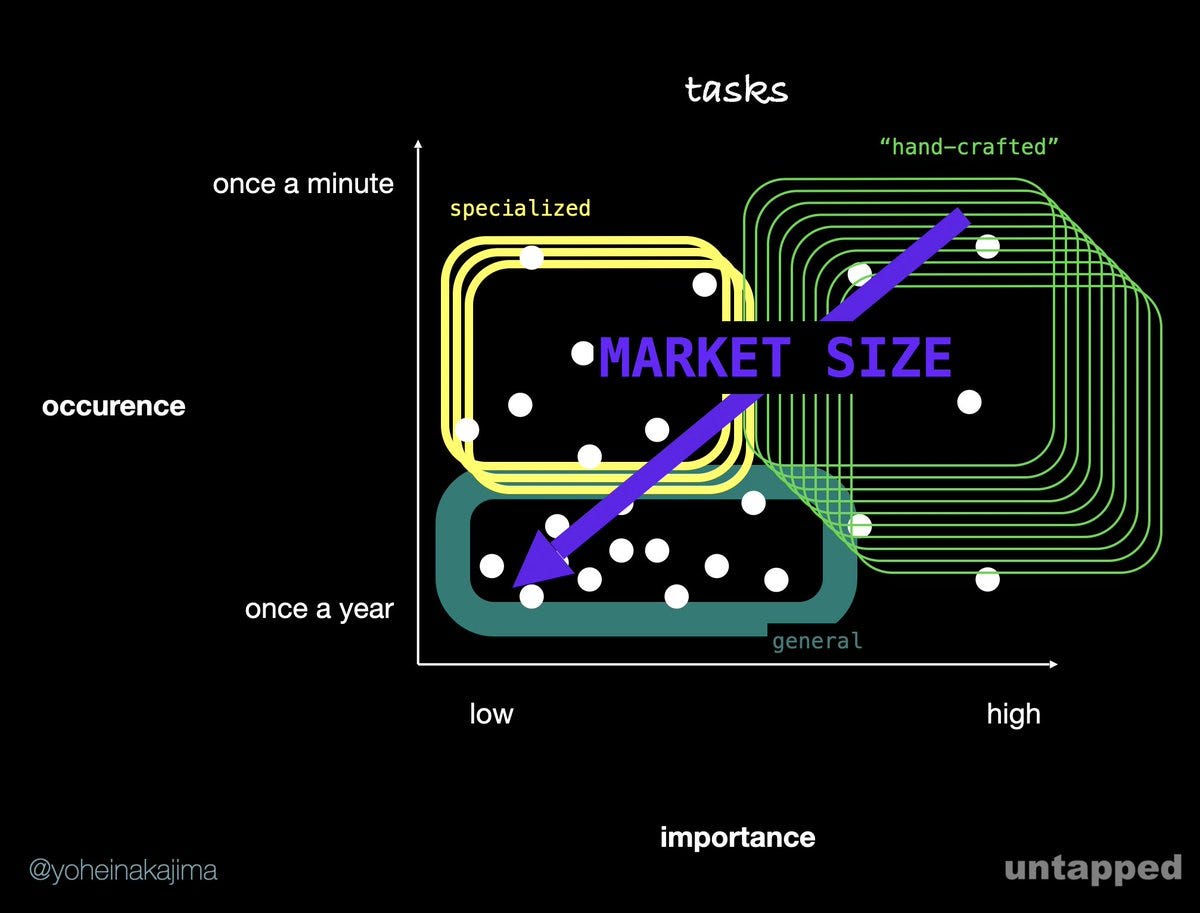

if it's important and all the time, you should hand-craft it.

the stuff that is all the time but not important is likely tasks types and tools that are relevant to your business, so a specialized agent can help.

for stuff that's occasional, it's all over the place so you need a general agent.

There is clearly more value in tasks that are important and happen all the time. But market size is opposite because specialized agents are niche and specific. General agents have a market size of "everyone" if it can do "everything".

I see you, I love you, slow is fast,

H